Electrical Tape - Global Market Share

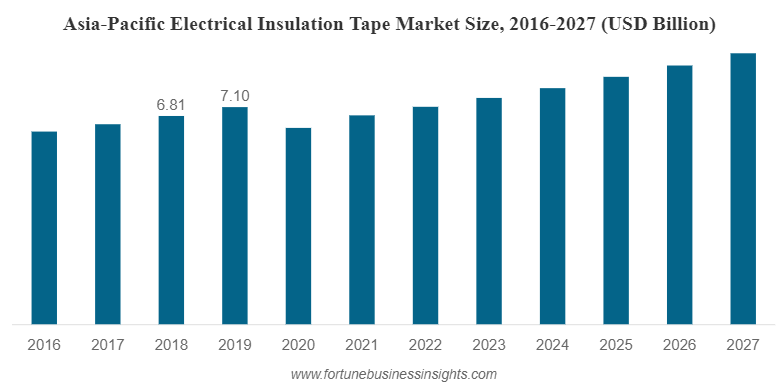

The electrical tape market has been changing over the years. Electrical insulation tapes have traditionally been used in the maintenance of aging electrical infrastructure. However, electricity grip modernization has expanded the use of these tapes. Consequently, the electrical tape market has been growing from an estimated value of USD 12.8 billion in 2019 to an anticipated 15.2 billion by 2027.

| ATTRIBUTE | DETAILS |

| Study Period | 2016-2027 |

| Base Year | 2019 |

| Forecast Period | 2020-2027 |

| Historical Period | 2016-2018 |

| Unit | Value (USD Billion), Volume (Mn Sq. m) |

| Segmentation | Material; Application; and Geography |

| By Material |

|

| By Application |

|

| By Geography |

|

(source:https://www.fortunebusinessinsights.com/)

COVID-19 Disruptions on Supply Chain

Global supply chains were hit drastically due to the outbreak of the COVID-19 pandemic. This disruption wasn’t helped by the cargo ship blocking the Suez Canal in March 2021. Due to these life events, the consumption pattern of necessities changed. In response to the changes, manufacturers tried to be agile in their operations and retain their market share.

However, limitations such as lockdown restrictions, low purchasing power, and low labor supply caused a double-digit decline in electrical tape sales. For the bigger part of 2020, the major electricity grid modernization projects were halted and funds were diverted to projects that supported the national economy.

While the decline in the sale of electric insulation tapes affected business in many ways, the pandemic also accelerated the localization process in key regions such as North America and Europe. Major stakeholders in the supply chain sort for strategies to shorten the chain and counter the pandemic disruptions, leading to the following observable trends:

1. Pursuit of Innovative Solutions for the E-vehicles

E-vehicles are wildly being adopted because of their economic and environmental benefits. Post-COVID, e-vehicles manufacturers are working closely with insulation tape manufacturers to identify products that meet the specific needs of the market. With vehicle technology becoming more complex, insulation tapes are playing a pivotal role in optimizing the overall performance of the vehicle. This period has also seen lawmakers in various countries bettering on e-mobility technology and solar technology being championed as a contributor to the development of electrical tapes needed for battery technology.

2. Modernization of Electricity Grid

The 21st century has seen a tremendous increase in energy needs attributed to changes in technology and equipment. To meet these needs, modernization of the existing grid and improving the aging electrical infrastructure are now a necessity. Governments are promoting electricity grip modernization to meet the expected needs of the growing population. This has also seen an increase in the demand for transformers to support the growing demand for microgrids and smart grids. As a result, electrical insulation tapes are needed to achieve optimum performance in the transformation at various operating temperatures.

3. Increasing Penetration of Consumer Electronics

Due to the strong presence of semiconductor industries in Asia-Pacific, the region has been a hub for manufacturing consumer electronics. Other factors such as low wages have also supported the manufacturing industries in the region. With the increase in disposable income in emerging countries, consumer electronics have a ready market. Development such as e-commerce has fueled the sales of consumer electronics and further driven the demand for electric tapes.

4. Alternative Technologies Constraining Market Growth

Manufacturers of gadgets and miniaturized electronic goods have increasingly been adopting insulating adhesive solutions. The adhesives are used in components such as transistors, diodes, and resistors. Since the adhesives are thixotropic and epoxy-based, they are more durable and suitable for miniaturized electronics. With the increasing trend of miniaturization, the demand for adhesives is only expected to grow, hindering the demand for tapes in electronics. In addition, alternate technologies are usually preferred for high-temperature applications where the chances of fire are high.

Electrical Tape Market Segmentation

The major players in the electric tape industry account for less than half of the global market share. They include companies like Intertape Polymer Group Inc. (Canada), tesa (Germany), Nitto-Denko (Japan), HellermannTyton (US), Saint-Gobain (France), and Pidilite Industries (India). However, the market is currently divided into two segments:

PVC Tapes Segment Dominance – PVC electrical tapes are the most commonly used because of their low cost and availability. They are preferred to conduct electricity in low temperatures and outdoor applications because of their resistance to abrasion and corrosion. On the other hand, glass cloth tapes are ideal for prolonged exposure to high temperatures. This may include wrapping coils, motor leads, oven controls, and furnace power supply systems.

Electrical and Electronic Application Dominance –In terms of application, electrical and electronics segments dominated about three-fifth of the global market. This trend is expected to continue as the electrical sector and electronics segments continue to expand. Developments such as the modernization of the electricity grip, transportation applications, aerospace applications, and increasing adoption of electric vehicles and locomotives are expected to continue growing this segment.

Market Insights

In 2022, these are the figures for Electrical Tape Market by Application/End-Use:

- Power Generation

- Chemical

- Cement and Printing

- Iron and Steel

- Others

Market by Type:

- PVC Electrical Tape

- Cloth Electrical Tape

- PET Electrical Tape

The electrical tapes market is at different stages in various regions. Developed regions such as Western Europe and North America boast relatively mature markets. Emerging markets such as Mexico and Brazil have seen rapid growth, especially with the penetration of electrical technologies and the rising number of electric vehicles in the region. However, factors such as economic and political instability are still major hindrances to growth in the region.

While the Asian-Pacific region is the market hub, only a few countries, including China, India, and Japan dominate. China dominates about 60% of the market share, with the major driving factors being the expansion of electric grips. Other factors such as urbanization and industrialization have also increased the consumption of electricity in the region.

Developed countries in the Middle East and Africa, such as Gulf Cooperation Council (GCC) and South Africa dominate the electrical tape market share. The major hindrances include political instability and poverty. Major events such as the Libyan crisis, the Israel-Palestine crisis, the COVID-19 pandemic, and the U.S.-Iran conflict further hinder the growth of electric tape market.

In 2019, the electrical and electronic segments accounted for over three-fifth of the global market, and this set to continue and be the dominant signal until 2027.

At Advanced Technology Supply, we convert and supply a range of electrical tapes and lacing tapes to the aerospace and to the electronics/electrical assembly industry.

Request a quote or contact us today to find out more and how we can help you.